Is the company solid

or risky

Protect your business from risks — access credit reports, financial statements, and much more from your smartphone or PC.

Know your customers, make better decisions.

s-peek is the first web and mobile application that allows you to easily assess the economic and financial health of your company, as well as your customers, suppliers, or partners.

Using s-peek is really simple: just enter the company name or VAT number to get the report and immediately find out if it's reliable.

What’s inside company reports

The financial data that makes a difference

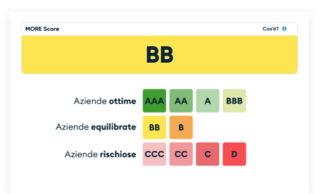

Credit Score

Get an immediate assessment of the company's financial health

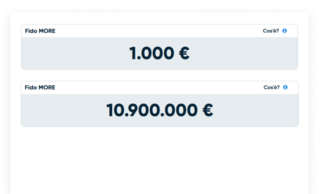

Trade credit limit

Discover the maximum annual credit limit available to the company

Negative factors

Check if there are any protests or ongoing bankruptcy proceedings

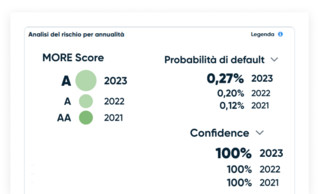

Risk analysis

Probability of default and 11 synthetic indices on the company's health

Company financial statements

Consult the last 3 publicly filed financial statements

Company data

Board of Directors composition, shareholder list, and share distribution

Different types of plans

Choose the plan that suits your needs

s-peek plus

subscription

from €799

excluding VAT

Monitor a portfolio of 250, 750, or 1000 companies for 12 months at a fixed cost.

Manage your company portfolio for one year: updated reports and notifications for every change in their financial health.

- 12 months at a fixed cost

- portfolio of 250, 750, or 1000 companies

- report updates included in the price

- company monitoring

- extended reports for all companies

- potential client extraction

- comparisons between companies

s-peek

on demand

from €16,99

excluding VAT

Get the company report without a subscription: use credits when you need updated information.

Select the credit package that's right for you and view the Flash or Extended reports of the companies you want to analyze.

- use credits for individual reports

- discounts on credit packages

- extended reports

- flash reports

Plans tailored for every type of business

s-peek is the ideal platform for both professionals and companies that engage in business relations with capital companies in Europe, as well as for banks and financial institutions operating in the small and medium-sized enterprise credit market, and for users who are not accustomed to interpreting financial data of a company from official documents.

s-peek Plus for SMEs

The s-peek Plus subscription is the ideal solution for small and medium-sized enterprises: it allows you to monitor a large portfolio of companies for one year, at a fixed cost.

With s-peek Plus, you will be able to:

- reduce risks with up-to-date data

- quickly understand the reliability of customers, suppliers, and competitors

- evaluate your financial situation for access to credit

- perform potential client extractions by geographical area and ATECO code

With s-peek Plus, you have the information you need to make strategic decisions and protect your business.

s-peek for micro businesses and professionals

s-peek On-Demand is the ideal solution for micro businesses and professionals who want access to financial information about specific companies, without a subscription.

With this flexible plan:

- You only cover the cost when you need updated data,

- using credits to purchase the company reports you need.

Perfect for:

- occasionally checking the reliability of customers, suppliers, competitors, or business partners

- getting company reports only when needed, without long-term commitments

Information always accessible

Get financial information on customers, partners, and competitors in just a few minutes: simply search for the company name, and s-peek provides updated and easy-to-interpret credit scores, wherever you are, from PC or smartphone. Perfect for businesses and professionals who want to make quick decisions based on up-to-date data, even when traveling or out of the office.

Credit risk analysis made easy

You don’t need to be a financial analysis expert to understand a company’s status. With s-peek, you get access to detailed tables and intuitive graphs to get an overview of the companies that interest you. The textual analysis makes data interpretation easier. The three-color scale (green, yellow, red) helps you identify critical factors and gives you an idea of your business partner’s reliability.

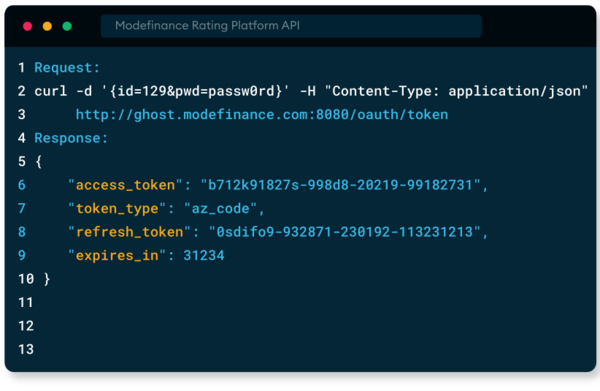

Data and models also available via API

Integrate s-peek's data and algorithms into your applications and business software. They are accessible using any programming language.

Contact usRely on a professional assessment

s-peek is the web and mobile application for creditworthiness assessment developed by the rating agency Modefinance, designed to help you easily and immediately evaluate the financial health of a company.

Frequently Asked Questions

What is the MORE Score?

MORE is the acronym for Multi Objective Rating Evaluation, the philosophy and methodology for quantifying credit risk created and developed by modefinance . MORE is used to evaluate the degree of solidity, and therefore reliability, of companies. The innovation of the MORE methodology lies in the careful study of the different economic and financial areas that describe a company: profitability, liquidity, solvency, efficiency, etc.

The vision behind MORE is that the better the balance between the different areas, the lower the overall risk associated with the company.

What is the innovation of MORE?

The heart of MORE is an innovative fusion between deep knowledge of the economic and financial dynamics of companies and the most modern methodologies in the numerical field, largely coming from the engineering analysis of complex systems.

The analysis is carried out through a series of different multi-dimensional and multi-objective algorithms that allow the observation and understanding of the different business dynamics, thus allowing the most accurate risk assessment possible. MORE uses all public information regarding the companies under examination.

Where does the data come from?

The data is provided by official information distributors that each national public body has appointed to collect annual financial statements of companies in its country. Financial data are always taken from official financial statements filed and verified. In some countries, where there is no official central source, the information provider may collect data directly from companies.

Why are you allowed to publish this information?

All the data we hold are freely available to the public and are published under the laws of each national authority. Therefore, no permits or authorizations are required.

How to request s-peek services via API?

The s-peek services (traffic light, FLASH Report and Extended12M Report) are also available via API.

For more information or to access the services via API, contact customer service at: technical.support@modefinance.com

Who is modefinance?

We are a Fintech Rating Agency active in credit rating and promoting a new vision for its use.

modefinance is a limited liability company (modeFinance Srl), registered in the Chamber of Commerce of Trieste (REA: TS – 129826) and registered with VAT No. IT01168840328.

Our offices: Building H, Area Science Park, Padriciano 99, Trieste, Italy.

Since 10 July 2015 modeFinance Srl is registered as a credit rating agency in accordance with Regulation No. 1060/2009 of the European Parliament and of the Council of 16 September 2009 (Credit Rating Agencies Regulation).

You can find all modefinance data in s-peek.

To contact us, write to: support@s-peek.com

How does s-peek plus subscription work?

You pay once a year and get up-to-date business reports for 12 months, real-time notifications on significant changes, company comparison tools, analytics for your portfolio, and the ability to filter and select new prospects.

From our blog

Do you want to know if your clients are reliable?

Join the 100k+ companies using s-peek

Free trial